Opening The Gates to Crypto - Where we are, and What's Next

In my previous post on “The State of Crypto in 2022”, Exchanges were talked about as the main point of on-ramping and off-ramping - a way to convert fiat into crypto and back.

We see extended capabilities by Regulators in the light of the Ukraine-Russia conflict, with the FBI Director stating “Very significant seizures.. of Russian-owned cryptocurrency” were made.

This goes against critics in the US Senate, whereby digital currencies were seen as a threat to national security due to the lack of enforcement, compliance and oversight.

This is no longer true and it means the US regulatory system, with the help of exchanges, are further ahead than what we originally thought.

What This Means For The Future

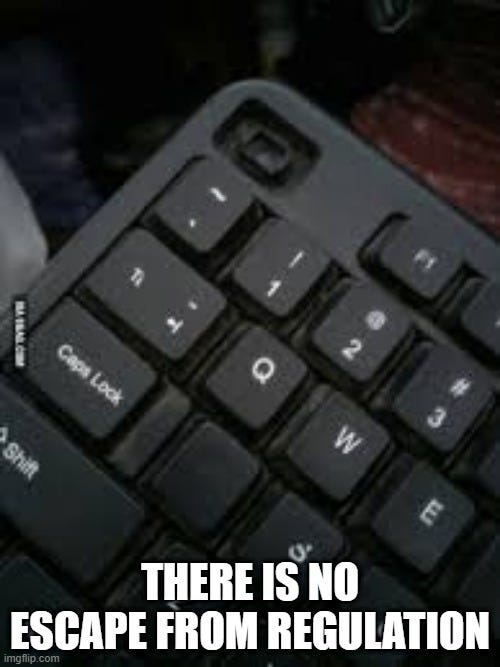

Sanctions are going to be very difficult for countries to avoid, even with crypto. Regulators still have power here.

Russia, forcing countries’ hands, had indirectly sparked off Regulatory interest in the area, and we can expect more/faster developments in crypto to come.For example, President Joe Biden had signed an executive order to create assessments and action plans to mitigate the risks that illicit use of digital currencies pose to the financial and national security sectors.

It gives a great example for other countries to build confidence in the crypto ecosystem, by working with Exchanges and Banks to have oversight over the inflows and outflows of fiat/crypto.

While regulators have a better understanding and hold over these entry/exit points, innovations for inflows and outflows following these frameworks are primed to pop up. We see new innovations for off ramping in several ways:

Large payment processors such as Stripe jumping back in crypto processing and enabling this for Merchants.

Web 3.0 and DAO innovators creating mechanisms to spend at Merchants directly with your token via QR code, or debit card (virtual or physical). Example: Kado Money. They may or may not use infrastructure such as Stripe, but there are many alternatives from credit card companies too.

In Singapore, we’re starting to see asset management and web 3.0 come together with in-principle approvals coming through the licensing pipelines by Monetary Authority of Singapore.