Weekly Market Links [13-19 Sep 2021] - Evergrande Starts To Sink, OTPs Lose Effectiveness, Apple-Epic Games Closure

Fears of contagion from debt-laden Evergrande shocks Chinese markets. Your OTPs aren't as secure as you think. Some closure for the app store ecosystem.

Apologies for the late post folks - was ironing out compliance adherence for the newsletter. Anyways, onwards!Countries

China

China Evergrande is in deep shi...I mean waters, as investors protest outside the HQ as a possible bankruptcy looms.

Evergrande’s Execs were found to have liquidated their positions before news broke.

For comparison, Lehman Brothers were liquidated for 600Bn. Evergrande’s debt just crossed 600B USD, which may just be the tip of the iceberg.

The repercussions of Evergrande failing are numerous, affecting properties it holds in its portfolio. Due to issues of going concerns, it may be unable to finance properties under development (getting stuck halfway), have building maintenance and management dropping in quality, and of course loss of capital for the investors. Contagion is much worse however.

Spiralling further, defaults could occur in the “broader financial sector”. This had previously been averted by persuading a group of investors to “waive their right to force a US$13B repayment”.

Sounds bad. Oh yea, it is. According to Evergrande’s Annual Report in 2020, 35% of their debt are interest bearing - meaning it incurs interest expenses of 180M yuan daily. At the moment, it only has 158B yuan in cash to repay all short-term debts and interests.

Europe

UK: Working pensioners would need to pay more in taxes due to tax reform.

1.3 million people above 65 are affected, which is >10% of pensioners in the UK.

Previously, payments rose annually by either inflation or average wage increase. Instead, this increase will not be linked to earnings, but the highest of either instead.

This poses problems to pensioners who were looking to retire, but cannot due to not having enough funds. Some are even living off “175...a week” (pounds).

These extra payments will be directed to pay for the NHS and social care.

Singapore

Brazen account attacks have been discovered, whereby attackers can spoof your OTP - and banks, telcos and police cannot do anything about it. Disturbing stuff.

Companies

Apple

Had a great victory in their case against Epic Games. The ruling states Apple had the right to charge a high commission due to their overarching system of “app e-commerce”.

In a gist, due to Apple’s “significant efforts” in providing security, seamless transactions, app discovery and more, the Judge had ruled Apple had the right to charge whichever they want to.

However, Judge Rogers also ruled digital games as a unique market, and that mobile game transactions were distinct from digital gaming transactions.

This means Apple will, moving forward, treat games differently compared to other apps.

Using these literal bullet points (hurhur), Apple can now focus their attention on Japan and South Korea, making all mobile game purchases go through the in-app purchase process to protect their behinds.

Alphabet / Google

Coming soon to a Chromecast near you, Alphabet could be giving you free TV.

This coincides with Alphabet’s moonshot project to link high-capacity Internet in India and Kenya.

Alibaba / Ant

China is planning to create a largely separate app in order to break up Alipay. Its esteemed IPO valuation was already significantly cut, and will likely worsen from this new development.

Specifically, it’s back-office processing of lending businesses Huabei and Jiebei have already been ordered.

Chinese regulations will also require Ant to “share user data to a new credit-scoring joint venture”, that will be partially owned by the government.

More follows. Both Tencent and Alibaba’s walled gardens are getting mowed down.

This poses opportunities for players who did not have as much market share in the app/messaging ecosystems, such as Bytedance, Baidu, and NetEase to name a few.

This forced opening is due to come into effect in a matter of weeks. It is likely that this quarter’s results for the Chinese tech giants would take a substantial hit.

Toyota

Expect fewer Toyotas on the road. Car production is estimated to be cut by up to 40% worldwide, due to a shortage of Semicon chips.

One of the largest car manufacturers, Semicon chips are being prioritized for mobile instead.

In a significant shift, Toyota has also moved away from Just-In-Time (JIT) manufacturing. They were one of the first movers of doing so, and this shift represents a shift in mindset, and likely hoarding in the future.

Inventory costs are likely to rise while exacerbating the supply of Semicon chips due to their increased demand.

We may see other automotive players affected, and following a similar strategy as well. Already, Honda is exhibiting similar characteristics. How does this affect you? Prepare for higher car prices!

Wise

For those looking at transferring money overseas, Wise has reduced remittance fees by up to 42%, for 19 countries.

It is possible that with recent FX infra upgrades, the cost of doing so has dramatically decreased for all money remittance players.

We may see other plays following suit - for the banks, a better exchange rate may be one of them.

Semicon

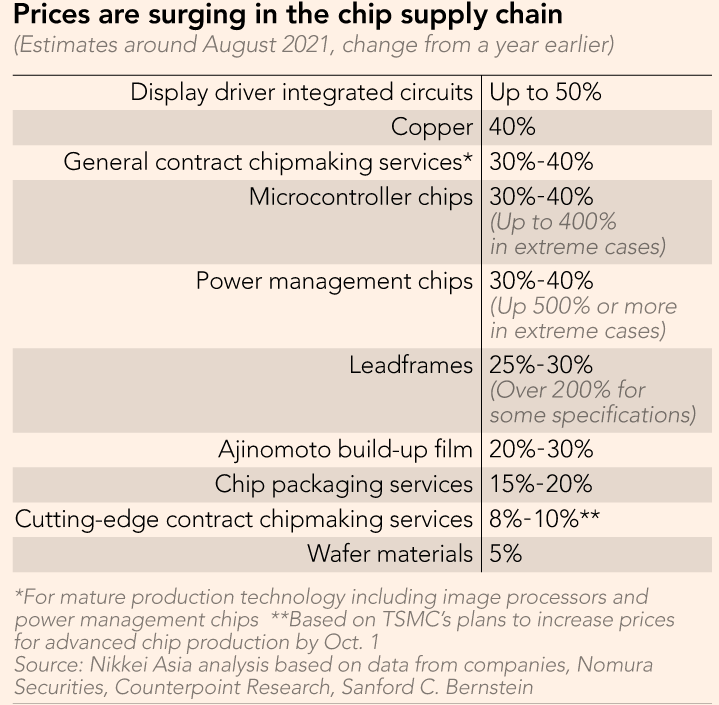

Surprise surprise - more indicators that prices of chips and devices are set to rise further. Here’s what Nomura found:

There have been cases of ‘double-booking’ - clients place orders for more chips than they actually need to secure production line space

This affects large manufacturers such as TSMC to forecast the real demand, and for other players, the common move would be to pass these costs along down the chain.

Ride-Hailing

Grab, the ride-hailing app-turned-delivery company is posting 2.1B in sales, with 15Bn in GMV.

Its pivot to food delivery is also being impacted, due to more severe lockdowns in regions such as Vietnam.

That’s not stopping Grab though - It is making losses of about 1BN yearly and is proceeding to list via the SPAC route as planned by Q4 2021.

Singapore may look at the US, UK and China in handling ride-sharing platforms regulation, especially for gig-workers.

Meituan and Ele.me have signed off on ensuring couriers do not register as independent businesses. This was a loophole used to “prevent or reduce legal obligations to the drivers”.

With this in place, it opens the door to more regulation to force platform-based businesses to support the “gig-economy” workers.

On the other side of the planet, Amazon and Deliveroo are offering free deliveries to those subscribed to Prime memberships

1M subscribers to Prime will benefit from this, equivalent to a “silver tier of Deliveroo Plus”.

It is also possible for Amazon to do more tie-ups in tertiary/ancillary spaces they don’t wish to compete directly, but will ultimately boost their subscriptions business model. Do you think they would go into ride-hailing / deliveries next?